The Las Vegas high-rise condo market is on pace for its second-best year in history despite a drop off during the third quarter when rising mortgage rates took a toll on the housing market in general.

A newly released report from Las Vegas research firm Applied Analysis shows there were 180 closings of the 21 high-rises tracked by the firm during the third quarter.

That’s down from an all-time record of 325 during the second quarter. In a record-setting 12 months of 2021 when there were 1,161 closings, there were 319 sales during the year’s third quarter.

Through the first three quarters of this year, Las Vegas recorded 798 high-rise closings, which puts 2022 on track to be No. 2 on the list. There were 843 closings in 2017.

The average closing price during the third quarter was $599,183, just below the $607,925 in the second quarter.

The price per square foot was $492 in the third quarter, down from $495 in the second quarter.

MGM Signature, a condo-hotel tower on the Strip, led the market with 41 closings. It was followed by Panorama Towers, 22; Juhl, 15; Allure, 15; Trump Las Vegas, 13; Palms Place, 12; Turnberry Towers, 10; Turnberry Place, 9; Veer Towers, 18; and the Waldorf Astoria, 6. The other towers have five or fewer sales.

The most recent top high-rise sale as the year comes to a close was $4.9 million for a penthouse on the 47th floor at the Waldorf Astoria. That co-listing of Shari Sanderson and Michelle Manley with Award Realty set a record price per square foot in the building at $2,305. Diane Varney with Coldwell Banker Premier represented the buyer. The all-cash deal closed Nov. 14.

The penthouse measures 2,126 square feet and has two bedrooms and three bathrooms. Sanderson described the penthouse as having breathtaking panoramic views of the Strip, double master bedrooms, a den, open layout, gourmet kitchen and top finishes.

Top condos on the market

A penthouse at Panorama Towers remains the top condo on the market at a price of $13.9 million, according to the multiple listing service. The two-bedroom unit listed by Michael Zelina, a broker/Realtor with Las Vegas Sotheby’s International Realty measures 8,017 square feet. It is a three-story residence that has four balconies that expand the living space to more than 10,000 square feet. The condo has been on the market for about 14 months.

“What’s happening in the condo market is the same thing happening in the housing market,” Zelina said. “It’s a pullback of buyers. Not knowing what the future holds creates a little bit of uncertainty in the marketplace. I think we have a lot of amazing condos right now that unfortunately aren’t selling. I haven’t seen a lot of prices drop yet, but I’ve seen a lot of new marketing come out. Buyers are on edge and are waiting to see if anything changes with mortgage rates, and the economy is on everybody’s mind. Everything has calmed down almost to a halt.”

Zelina said he expects it to remain slow for a little while even with a great property given the concerns over the economy and interest rates.

The No. 2 condo on the market is at One Queensridge Place in the west valley. It measures 14,719 square feet with six bedrooms and 6½ baths. It is listed for $13.9 million.

The condo is listed by Gadi Hahamy, a Realtor with Realty One Group, and referred to as the “The Crown Jewel” of Queensridge. He said it’s been on the market for about two months.

Hahamy called it “a true masterpiece, with details handcrafted with the finest imported materials from Europe, flooring created in hand-placed precious stones, Jerusalem stone walls, hand-carved built-ins, custom Venetian plaster finishings, handcrafted marble and iron custom railings.”

There’s a private elevator to a 24-foot entry with double iron and stone staircase, leading to the second floor, and to a hidden third-floor retreat. Every room is crafted and designed so no two rooms are alike, Hahamy said. It has a 2,500-square-foot terrace, with unobstructed Strip views and a private pool, multiple additional terraces attached to bedrooms and baths, and retractable pocket glass patio doors.

Hahamy said it’s owned by a group of Southern California investors who acquired it more than two years ago. He said he’s getting interest in the condo from potential buyers from Dubai, professional athletes and professional sports team owners.

“It’s one of those places you go in and don’t know if you are walking into the Bellagio or the lobby of The Vatican,” Hahamy said.

The No. 3 condo on the market is at the Waldorf Astoria for $9 million. On the 46th floor, the penthouse measures 3,980 square feet with three bedrooms. Manley is the listing agent. The condo is fully furnished with views facing the north, east and south.

Manley said it has high-end design furnishings, stunning finishes, marble and stone custom cabinetry.

“It’s probably the best unit in the building or close to it,” Manley said. “Penthouses rarely become available. It’s the largest unit over there and in the prime position of the building.”

Manley said she sold the unit a decade ago to her client as a grey shell, and they created a customized floor plan that makes it one-of-a-kind in the building. The dining room table is valued at $200,000, Manley said.

“There’s a lot of interest already,” Manley said. “I have three people flying in from Los Angeles. It’s well-received so far.”

Manley said she’s not seeing a slowdown in the luxury condo segment. She said she’s working with so many cash buyers coming in and wanting high-end properties.

She pointed to the 47th floor sale at the Waldorf Astoria for $4.9 that was sold twice within two months. The first time it was sold to her buyer for $3.93 million who then resold it for $1 million more.

“It was a bidding war the first time around, and somebody who missed it the first time really wanted that top floor,” Manley said.

Sanderson said having a market with exclusive clientele helps shield against broader conditions.

“The Waldorf Astoria holds its value,” Sanderson said. “It’s a popular building.”

Hahamy said higher mortgage rates have impacted the condo market along with the housing market because it requires people to put more money down to make the purchase. Those ultra luxury buyers, however, pay with cash and aren’t impacted by the interest rates, he said.

There are concerns, however, and he’s seen a slowdown that doesn’t show any sign of abating.

“People are afraid because of the stock market and what’s going on in Europe,” Hahamy said. “They are holding money. And banks are also very cautious. Either you have to put 35 percent down, or it’s hard to get a decent loan.”

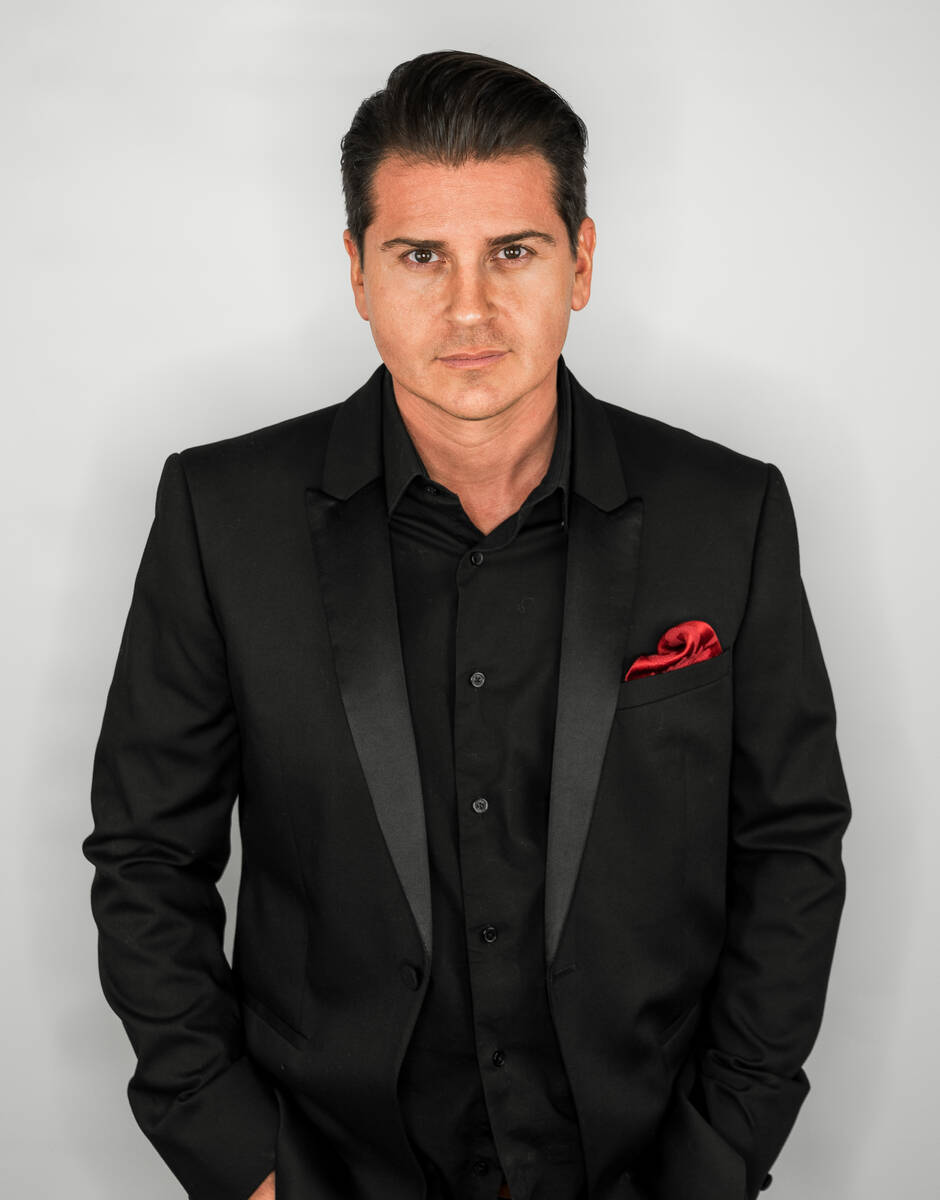

Frank Napoli, owner of The Napoli Group at Berkshire Hathaway HomeServices, said he has listings of 11 luxury condos in the Waldorf Astoria, including one penthouse and five condos for purchase, three condos for lease and two off-market listings.

The high-rises range in price from $1.06 million to $6.5 million for purchase and monthly rents ranging from $8,800 to $17,000, according to Napoli, who lives in the building.

He said there was a lull before the midterm elections but has seen some bounce back in the market since then.

There’s a buildup of inventory that’s more of a normal market, but nothing as high as 2020 when the condo market slowed down sharply due to COVID-19, he said.

“The sales have slowed down and leads have slowed down, but it feels like in the last week or so there’s been more of an uptick,” Napoli said. “I have a listing under contract at Waldorf and another (soon), and I have two more buyers coming in from California. Both are looking at Waldorf, and I have another person looking at The Martin.”