The local industrial market’s strength continued in the first quarter, with strong absorption, decreasing vacancy rates and asking rental rates increased from a year ago, a report shows.

Xceligent, a provider of U.S. commercial real estate information, reported vacancy rates fell to 6 percent in this year’s first quarter from 7.6 percent a year earlier and down from 6.5 percent rate in 2015’s fourth quarter.

The city also had a drop in direct vacancy from the fourth quarter’s 6.4 percent to 5.9 percent. Absorption in the direct market held the majority of the movement with 903,505 square feet. Just over 13,000 square feet was absorbed through sublease — leaving an absorption of 916,805 square feet of industrial in the first quarter. Last quarter’s absorption was 481,035 square feet.

Nearly 671,000 square feet the city’s total absorption came from the warehouse-distribution sector. Light industrial compiled 134,988 square feet of the number and 110,908 came from the flex and research and development sector.

The northeast valley had the strongest absorption rate among submarkets in the first quarter with 425,000 square feet positive absorption.

The region also had the largest absorption change in the first quarter with Priority Wire and Cable Inc. moving into Dermody’s 233,169-square-foot LogistiCenter Cheyenne. The second-largest move was Amazon.com taking over 84,000 square feet at the Sunset Parkway Business Center in the southwest.

Some of the city’s largest transactions in the first quarter occurred in Henderson with Levine Properties selling nearly 130,000 square feet of industrial at nearly $12 million. Panattoni Development Co. also sold 103,000 square feet for over $7 million in the northeast.

In the first quarter, the valley had nearly 1.9 million square feet in projects under construction. The southwest was expecting the bulk of it with 738,904 square feet; the northeast was second with 722,413 square feet.

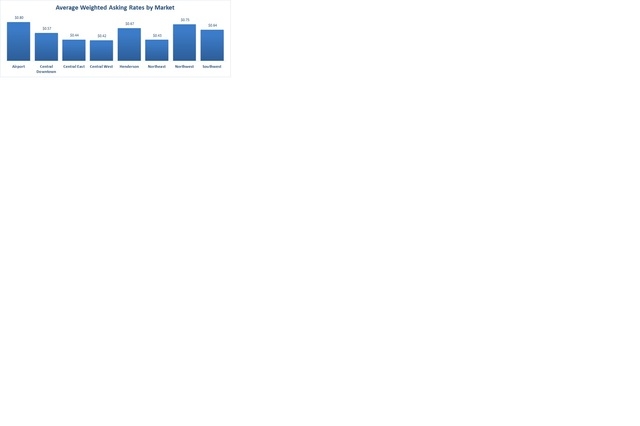

In the northwest, positive gains could be seen in the region’s existing product. Average asking lease rates in existing product, under a triple net structure, saw an increase of about 44 percent in the first quarter of 2016 over the first quarter of 2015 — from 52 cents a square foot to 75 cents a square foot.

Along with being a region with high growth in average asking rental rates, the northwest also carries one of the highest average asking rates in the Las Vegas area — coming in only behind the airport submarket at 80 cents per square foot.

The areas with the lowest average asking rates were the central west, northeast and the central east submarkets, at 42, 43 and 44 cents per square foot, respectively.

Asking rents increased citywide — from 56 cents in the first quarter of 2015 to 63 cents per square foot in the first quarter of 2016.

The city’s average increased by 3 cents from the fourth quarter of 2015—the largest gain compared with all submarkets in the city. The next highest gain or loss in any submarket was 2 cents; some regions experienced no change at all.

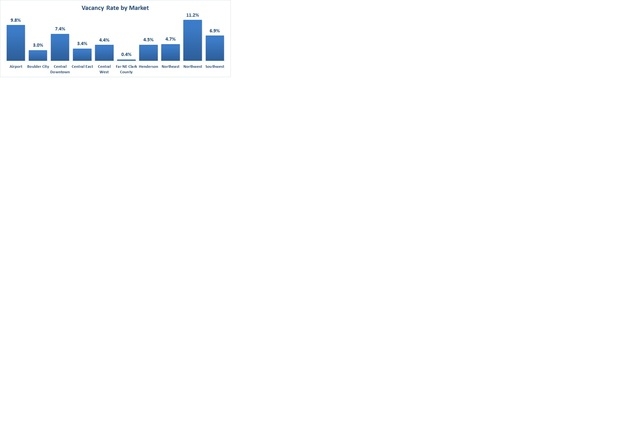

The lowest vacancy rates are in the city’s eastern regions. In the far northeast, vacancy sat at 0.4 percent in the first quarter, down from 1.3 percent in the fourth quarter of 2015.

The highest vacancy rates were in the northwest submarket at 11.2 percent, an increase from the first quarter of 2015 when vacancy was at 7.8 percent.

The airport submarket had the second highest vacancy rates at 9.8 percent.

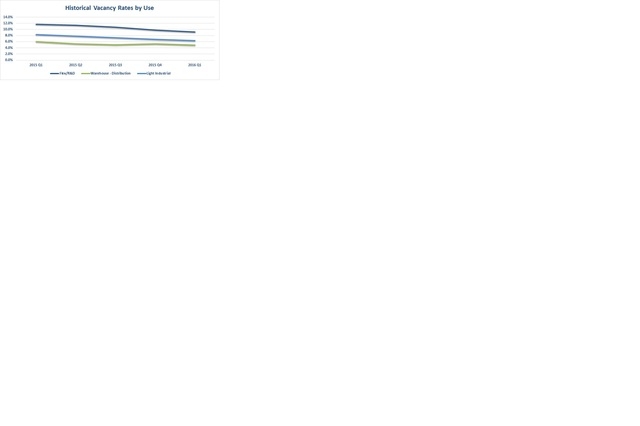

Vacancy rates by use were lowest in the warehouse-distribution sector at 4.9 percent, falling from 6 percent in the first quarter of 2015.

The highest rate was in flex and research and development space at 9.2 percent, falling from 11.7 percent in the first quarter of 2015.