A penthouse that takes up the entire 45th floor at The Martin is on the market for $18 million and would mark a record in Las Vegas if sold in that price range.

The Palms rooftop bachelor pad owned by Phil Maloof has the existing record at $12.5 million set in 2019. That unit covers the entire 58th floor.

The listing comes as sales in 2020 in the Las Vegas high-rise condominium market fell 17 percent from 2019 and prices dropped double-digit percentages as that segment compared with single-family homes took a hit from the pandemic, according to research firm Applied Analysis.

In January, Real Estate Millions reported luxury condo sales of $1 million and higher were down 20.6 percent for 2020.

The Martin is the third phase of the Panorama Towers complex on the west side of the Interstate 15 across from the Strip.

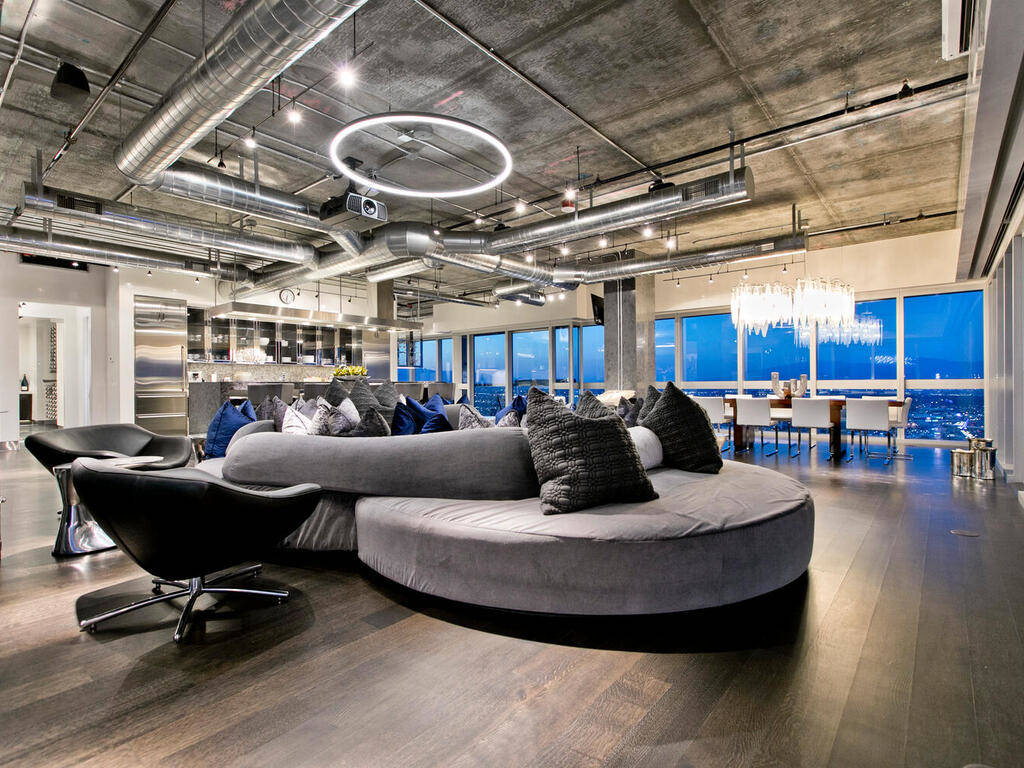

The penthouse measures 12,940 square feet and has five bedrooms, including two master bedrooms, and eight bathrooms and has an additional 2,000 square feet of balcony space with four terraces. It has 360-degree view of the entire valley.

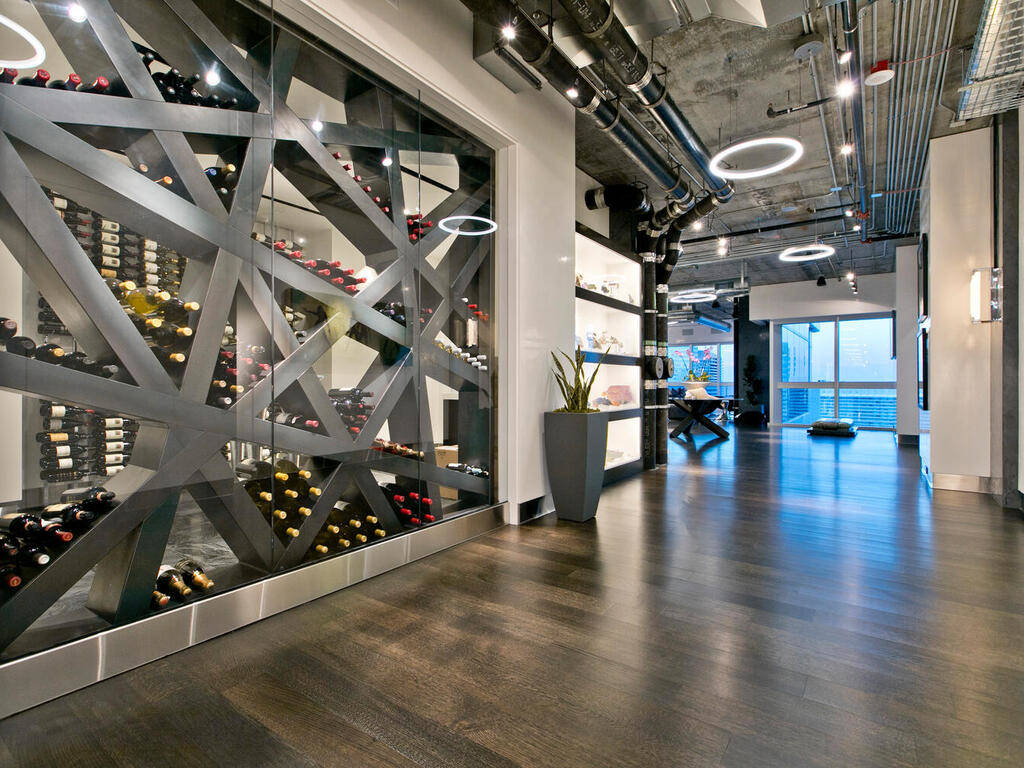

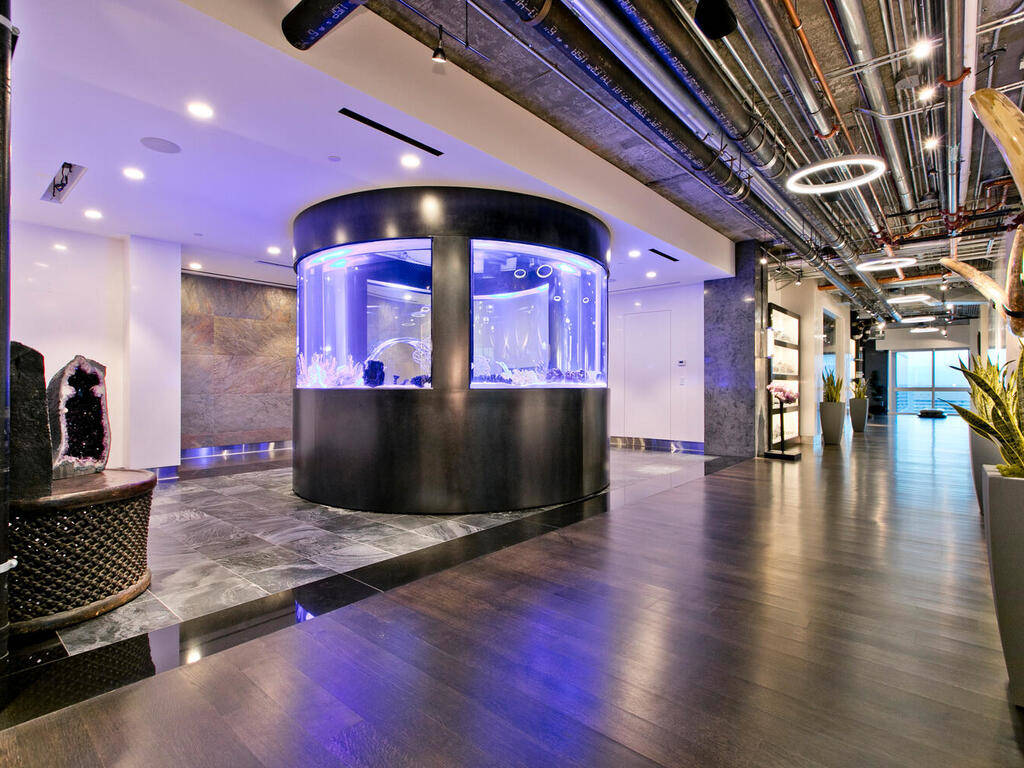

Listing agent Michael McGraw, a Realtor with Elite Realty, said it’s equipped with a professional gym, steam room, sauna and cold plunge. It has a catering kitchen, private wine room, bar, game room and theater. It also has a custom circular fish tank that has a bed in the middle where you can watch the fish swim around.

“It’s the most incredible house I have ever been to in the world,” McGraw said. “It’s unbelievable. It’s the only entire top floor in Las Vegas right now. The Venetian plaster walls are incredible. All of the furniture was custom-made for every room. There are like 30 TVs up there and a drop-down screen and theater. It’s crazy.”

The owner’s name is not listed in Clark County records, and McGraw would not disclose it to preserve the owner’s privacy.

He said the owner, who has homes in other countries, bought it as a gray shell, and it took two years to build the penthouse out. The owner bought it for $4.25 million in 2016 and spent about $12 million to $13 million to improve it.

McGraw said he has received several offers already and expects it to be sold within the next couple of months. Most of the showings are people from out of state, he said.

“The buyer will be someone who likes an amazing penthouse and likes to entertain and bring guests in,” McGraw said. “It’s for someone who wants everything.”

High-rise market numbers

A report released by Applied Analysis that looks at the entire high-rise market at all price points reveals that there were 505 sales in the valley’s 21 condo towers in 2020. That is down from 607 sales in 2019 and down nearly 40 percent from 836 sales in 2018.

Interest in condos has fallen as people prefer single-family homes and yard space during the pandemic and are dissuaded by curtailed property amenities such as gyms and other services.

“The high-rise condo market in 2020 has clearly been impacted by the COVID-19 health crisis and related response, including the shutdown of hotel-casino properties along with amenities housed within those buildings,” Applied Analysis principal Brian Gordon said. “With a number of these high-rise projects located or around the Las Vegas Strip corridor as well as downtown, the demand weakened as a result of the health crisis.”

Gordon said that contrasted to the decline in sales between 2018 and 2019, which came as prices escalated and there were fewer units on the market.

The average price of condo sales in 2020 was $527,831, which is 12 percent lower than the $598,728 average price in 2019. The price per square foot of units sold was $401, a decline of 5.6 percent from $425 in 2019.

Gordon said the mix of sales within a building in any given year can affect the average price and price per square foot.

As for what to expect during 2021, Gordon said it will follow the path of the tourism sector and economy and lag the overall recovery.

“There’s no question that the industry has been hard hit with a number of these projects sourced to second and third homebuyers and leisure travelers coming to Las Vegas several times a year,” Gordon said. “That dynamic has shifted dramatically in 2020, and we would expect to see more of the same as the health crisis remains a challenge at least during the first half of 2021.”

Gordon said the timeline for recovery could be extended into 2022 as it takes time for travel to Las Vegas to return to pre-pandemic levels.

Condo sales breakdown

MGM Signature and Turnberry Place took the biggest hits in condo sales in 2020 as 15 properties recorded declines. Four showed gains, and two remained the same between the two years, including Trump International.

MGM Signature, which is a condo-hotel where owners can put their properties into the MGM Grand rental pool, had 47 sales in 2020, down more than one-third from 72 sales in 2019. The average sales price also took a big dip, nearly 19 percent, dropping from $329,095 in 2019 to $268,125 in 2020, Applied Analysis reported.

“I would attribute MGM Signature to travel numbers,” said Frank Napoli, a Realtor with Berkshire Hathaway HomeServices, who had the top sale in 2020 at $4.5 million at the Waldorf Astoria. “The return of investment on those is not looking as good because travel is down as are the room rates. In addition, one thing I attribute to condo-hotel values is the lack of financing available for products like that. They are mostly limited to cash buyers, which reduces the amount of available buyers for that. It’s always been a challenge for condo hotels.”

Turnberry Place, which ranks No. 4 in terms of its luxury price point, saw 37 sales in 2020, down from 60 in 2019, according to Applied Analysis. Despite that decline, the units that did sell were at a higher price point in 2020. The average sales price was $942,061, or $353 per square foot. That is up from $751,605, or $319 per square foot in 2019.

That contrasts to Turnberry Towers with 45 sales, two fewer than in 2019. The average price was $484,878, or $364 per square foot, which was higher than the $455,767 in 2019 but $1 less in price per square foot at $365.

Napoli said Turnberry Towers fared much better because it has a lower price point that is more affordable for buyers.

“Turnberry Place is a higher price point, and that is consistent in all towers that have a higher price point,” Napoli said. “Some of these lower priced-point towers are still a good opportunity to either establish residency or enjoy the high-rise lifestyle.”

Among the top three luxury towers in Las Vegas, One Queensridge Place in the west valley had 10 sales in 2020, down from 20 sales in 2019. Its average sales price was $1.5 million, down from $1.89 million in 2019. The price per square foot at $495 in 2020 was only down $1 from the previous year.

Park Towers in Hughes Center east of the Strip had two sales in 2020, down from six sales in 2019. The average price was $1.9 million in 2020, down from $2 million in 2019. The price per square foot was $596 in 2019 and $493 in 2020.

The Waldorf Astoria in CityCenter — which is a private residence condo tower from the 24th story to the 47th story and a hotel below that level, had 16 sales in 2020, two fewer than 2019. The average price per sale was $2.3 million in 2020, or $1,159 per square foot. In 2019, it was $2.5 million or $1,253 per square foot.

“I attribute (the decline in luxury sales) to the pandemic,” Napoli said. “Part of living in a high-rise is being able to enjoy amenities that a building has to offer, and during the pandemic, the amenities were completely shut down or very limited, which changed the experience. Buyers focused more on primary residents so they wouldn’t have to worry about being affected by the restrictions that the pandemic brought. There was a good portion of this year where people wanted to be safe and away from other people and not use elevators and common areas until there’s a better handle on the virus.”

Napoli said that the Waldorf sales’ decline of only two says a lot about that tower and its desirability. The pandemic’s impact on condo living was a game changer for those sales in 2020, he said.

“Had it not been for the concerns and limitations that the pandemic brought, the high-rise market would have taken off like the single-family residential market,” Napoli said. “The fact that it has done so well during a pandemic is a good sign of what’s to come once we return to some level of normalcy. The high-rise is a great option and a great product, and I think once we get back on our feet with our sports and entertainment and have our normal audience, this market is going to take back off like we have never seen before.”

Palms Place condo-hotel was the most prominent property to show a gain in sales, but no property showed a steeper decline in prices. It had 50 sales in 2020, which is six more than 2019. The average price was $278,750 or $359 per square foot, down sharply from $618,251, or $646 per square foot. That price drop comes as the Palms Las Vegas casino has been closed since March, when the pandemic shut down the industry. There is no date for its reopening.

Napoli attributes the sales gain to a drop in prices.

“That’s a condo-hotel product where the majority of people buying in there are investors,” Napoli said. “The lower price means the investment makes more sense.”

The other towers that saw 2020 gains were Boca from three to four; Juhl, 29, which is up from 23; and One Las Vegas at 46, up from 45.

“One Las Vegas has a different kind of buyer because it’s off the Strip and more of a residential feel, and that price point is more affordable for most people versus a novelty buyer who wants something on the Strip or someone looking to establish full-time residency,” Napoli said.

Veer Towers in CityCenter had 34 sales in 2020, which is one less than 2019. The average sales price was $603,806, or $632 per square foot, in 2020 compared with $676,940, or $637 per square foot, in 2019.

“Veer is another great opportunity and shares the same neighborhood amenities as the Waldorf Astoria and has a Las Vegas Boulevard address,” Napoli said. “The units are spectacular and at a very reasonable price per square foot to be in that location, with that quality, and with those amenities.”

The Vdara condo-hotel at Aria in CityCenter had three sales, down from 15 sales in 2019. That is no surprise given hotel revenue is down and there are primarily cash buyers, Napoli said.

“Once everything picks back up, those products will do the same,” Napoli said.

Panorama’s three high-rises, one of which is The Martin, had 65 sales in 2020, one less than in 2019. The average price was $510,988, or $373 per square foot, compared with $554,688, or $367 per square foot, in 2019.

“Panorama is a great price point for someone who wants to live in a high-rise, especially for someone who doesn’t necessarily want to be on the Strip but wants close proximity to the Strip,” Napoli said.

The Trump International condo-hotel had 25 sales, the same as in 2019. The average sales price remained steady. It was $387,155 in 2020, or $511 per square foot. In 2019, it was $381,912, or $522 per square foot.

“That’s a desirable price point and attractive rate of return for investors,” Napoli said.

The end of 2020 saw 580 high-rises for sale with an average price of $783,655, or $552 per square foot, according to Applied Analysis. Condo hotel-towers led the way in units on the market.

MGM Signature had 68 units for sale. Trump Las Vegas had the second most at 64. Panorama Towers had 53. Palms Place had 42, the research firm reported. Among luxury towers, Turnberry Place had 38, the Waldorf Astoria had 36, One Queensridge Place had 23, and Park Towers had nine.

About the penthouse

Price: $18 million

Location: The Martin, just off the Strip

Size: It takes up the entire 45th floor of the high-rise and measures 12,940 square feet with an additional 2,000 square feet of balcony space with four terraces. It has five bedrooms, including two master bedrooms and eight bathrooms.

Features: By occupying the entire floor, it has 360-degree view of the entire Las Vegas Valley. Other features include: professional gym, steam room, sauna and cold plunge, catering kitchen, private wine room, bar, game room and theater. It also has a custom circular fish tank that has a bed in the middle where you can watch the fish swim around. The unit has Venetian plaster walls and all of the furniture was custom made for each room.

Listing: Michael McGraw, Elite Realty